A Primer on Order Flow Trading

As financial markets evolve and become increasingly sophisticated, the complexity of the analysis required to identify opportunities for profitable trading is continually rising. Amidst this evolution, order flow trading has emerged as an innovative approach to financial market analysis that enables traders to unravel the hidden dynamics of the supply and demand for financial instruments.

At its core, order flow trading is a cutting-edge analytical framework that involves studying the dynamic flow of buy and sell orders in real-time. By penetrating the veil of opacity that shrouds the market's inner workings, traders can gain valuable insights that are unattainable through traditional technical or fundamental analysis. Through analyzing order flow data, traders can predict and preempt potential price movements and market trends that might have otherwise gone unnoticed.

Order flow data is an information-rich trove that provides traders with access to a wealth of information about the trading patterns of different players in the market, such as retail traders, institutional investors, or high-frequency traders. Order flow data includes an array of data points such as the frequency and volume of buy and sell orders at varying price levels, and information on the identity of the traders behind the orders. With this data, traders can gain an edge in the market by understanding the characteristics of the trading activity, allowing them to make more informed trading decisions based on the actual buying and selling activity in the market.

In summary, order flow trading is a game-changing analytical framework that unlocks the previously hidden secrets of financial markets. By leveraging the power of order flow data to study the dynamic flow of buy and sell orders in real-time, traders can gain insights that are invaluable in their quest to identify and execute profitable trades.

Platforms Used for Order Flow Trading

To effectively trade using order flow data, traders need access to advanced trading platforms that provide real-time data feeds and analysis tools. These platforms typically provide a range of features to help traders visualize and analyze the order flow data, such as:

Level 2 order book: This is a detailed view of the current market depth, showing the order flow at each price level. It allows traders to see the volume of orders at different price levels and the sizes of the orders.

Time and Sales data: This displays a real-time record of all trades that have taken place in the market, including the time of the trade, the size of the order, and the price at which the trade was executed. It can help traders to identify patterns and trends in the market.

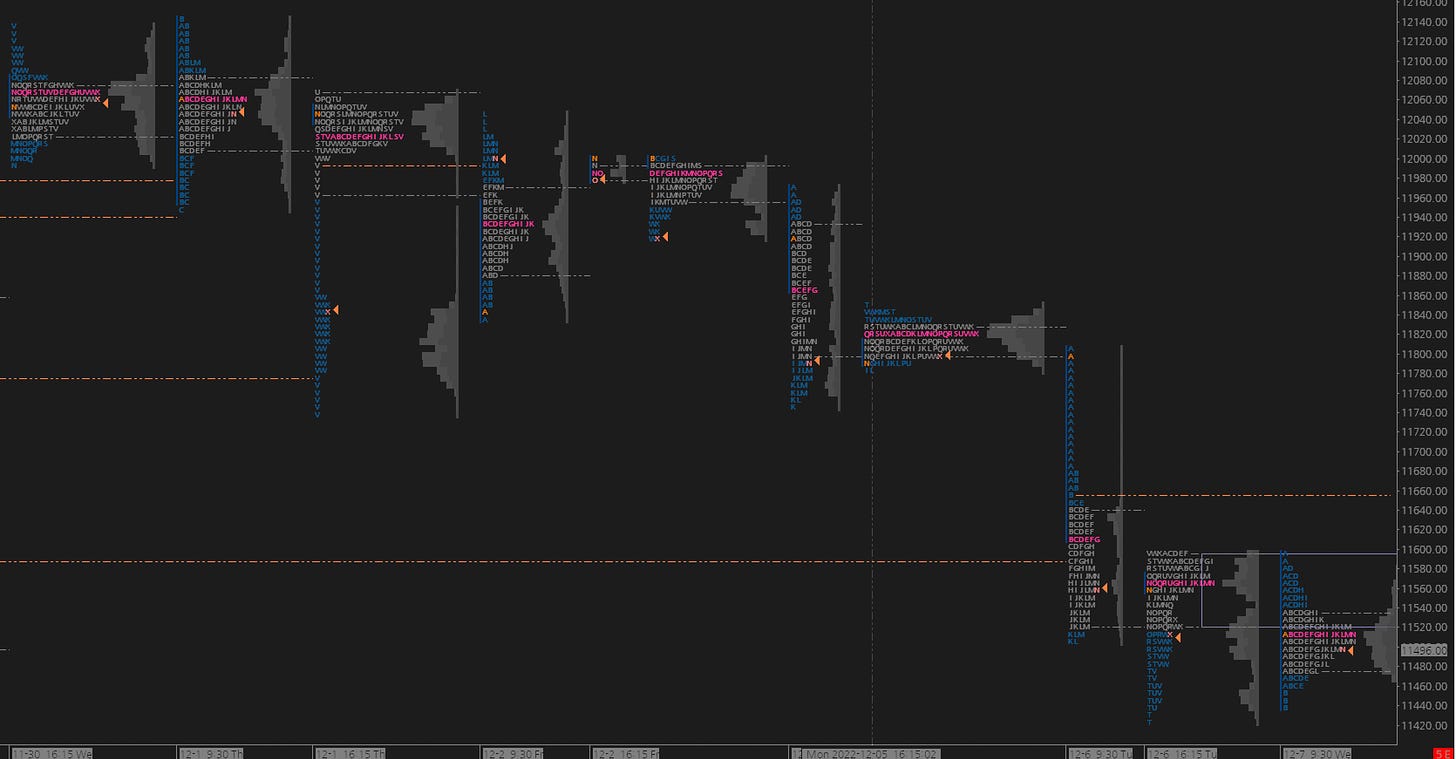

Footprint charts: These are specialized charts that show the order flow data in a visual format, using color coding to indicate buying and selling activity at different price levels. Footprint charts can help traders to identify significant support and resistance levels in the market.

Volume profile: This shows the volume of orders that have been executed at different price levels over a specific time period, giving traders a clear picture of where the market has been most active and where there may be significant support and resistance levels.

Some popular platforms for order flow trading include Sierra Chart, MarketDelta, and Bookmap. These platforms provide access to real-time data feeds and advanced analysis tools that can help traders to make more informed trading decisions based on order flow data.

In summary, order flow trading is an approach to financial market analysis that involves studying the real-time flow of buy and sell orders in the market to gain insight into the underlying supply and demand dynamics. To effectively trade using order flow data, traders need access to advanced trading platforms that provide real-time data feeds and analysis tools. In the next chapter, we'll dive deeper into the tools and indicators used in order flow trading.

What is Auction Market Theory?

Auction Market Theory (AMT) is a powerful tool for traders looking to gain a better understanding of market and order flow dynamics. Developed by Pete Steidlmayer in the 1980s, AMT is based on the principles of supply and demand and the auction process. In this blog post, we'll take a closer look at AMT and how it can help traders make more informed trading decisions.

At its core, AMT is a framework for understanding how markets work. It is based on the idea that markets are like auctions, with buyers and sellers interacting to determine the price of a particular security. AMT is focused on the behavior of market participants, and how their actions can influence the direction of the market.

AMT is based on several key concepts:

Price discovery: In an auction, the price is discovered through the interaction of buyers and sellers. Similarly, in financial markets, the price of a security is determined by the supply and demand for that security.

Market structure: The structure of the market, including the number of buyers and sellers and the size of their orders, can influence the direction of the market.

Value areas: Value areas are price levels where a significant amount of trading activity has taken place. These areas can act as support or resistance levels in the market.

Market profile: A market profile is a graphical representation of the auction process. It shows the distribution of prices and the volume of trading activity at each price level.

How can Auction Market Theory help traders?

AMT can help traders gain a better understanding of the market and order flow dynamics. By analyzing the behavior of market participants and the structure of the market, traders can identify potential areas of support and resistance and make more informed trading decisions.

Here are some ways that AMT can help traders:

Identifying support and resistance levels: By analyzing value areas and market profiles, traders can identify potential support and resistance levels in the market. This can help them to identify potential entry and exit points for their trades.

Understanding market structure: By analyzing the structure of the market, traders can gain a better understanding of the balance of power between buyers and sellers. This can help them to identify potential market trends and make more informed trading decisions.

Analyzing order flow: AMT can help traders to analyze order flow data and understand how the actions of individual traders can influence the direction of the market. This can help traders to identify potential market trends and make more informed trading decisions.

Order flow is the process by which buyers and sellers in a financial market place their orders to buy or sell securities. These orders represent the supply and demand of a particular security and can have a significant impact on the direction of the market.

When buyers and sellers place orders, they are essentially making a commitment to purchase or sell a particular security at a specific price. These orders can be executed immediately, or they can be placed in a queue until the price reaches the specified level.

The flow of these orders can provide valuable insights into why markets are moving. When there are more buyers than sellers, this creates a demand for security and can drive up the price. Conversely, when there are more sellers than buyers, this can create a surplus of security and drive down the price.

Market orders and limit orders are the two primary types of orders that traders can use to participate in the order flow. A market order is an order to buy or sell a security at the current market price, while a limit order is an order to buy or sell a security at a specified price or better.

There are several factors that can influence the flow of orders and, in turn, the direction of the market. Here are some of the most significant:

News and events: News and events such as economic reports, corporate earnings, and geopolitical developments can significantly impact the flow of orders. Positive news can create a demand for securities, while negative news can drive down demand.

Market sentiment: Market sentiment refers to the overall feeling or attitude of traders and investors towards the market. When sentiment is positive, there is a higher demand for securities, which can drive up prices. Conversely, when sentiment is negative, there is a lower demand for securities, which can drive down prices.

Technical analysis: Technical analysis is the study of past market data, such as price and volume, to identify trends and patterns that can help traders predict future price movements. Technical analysis can be used to identify potential areas of support and resistance, which can influence the flow of orders.

Let's take a practical example of Auction Market Theory in the financial markets by looking at a hypothetical scenario in which a stock is trading at $100.

In AMT, the price is considered to be the most important information about the market. However, AMT also focuses on other factors that can provide valuable insights into market dynamics.

Using AMT, we can divide the $100 price level into three value areas: the upper-value area (UVA), the point of control (POC), and the lower-value area (LVA).

The UVA is the price level above $100 where there is low trading volume. The POC is the price level at which the most trading volume has occurred, which in this case is $100. The LVA is the price level below $100 where there is low trading volume.

Now, let's say that the stock's price starts to rise and reaches $105. This means that there is more demand for the stock than supply, and buyers are willing to pay a higher price to acquire it.

As the price rises, the UVA moves higher, and the LVA moves up as well since there is now more demand for the stock. The POC, which is still at $100, shows that the most trading volume is still occurring at that price level, indicating that $100 is an important level of support.

However, if the stock's price starts to fall and reaches $95, this means that there is more supply than demand, and sellers are willing to accept a lower price to sell their shares.

As the price falls, the UVA moves lower, and the LVA moves down as well, indicating that there is now more supply for the stock. The POC may also shift to a lower price level, as traders adjust their strategies in response to the changing market conditions.

By analyzing the market using AMT, traders can gain valuable insights into the supply and demand dynamics of the market and make more informed trading decisions. They can use this information to identify potential areas of support and resistance and to adjust their trading strategies accordingly.

In Auction Market Theory (AMT), balance and imbalance refer to the relationship between the supply and demand of a financial instrument in the market.

A balanced market is one where the supply and demand of a particular instrument are roughly equal, meaning there is no significant buying or selling pressure. In a balanced market, the price tends to trade within a range, with support and resistance levels acting as a floor and ceiling for the price movement. Traders can use this information to look for trading opportunities at key support and resistance levels.

On the other hand, an imbalanced market is one where there is an excess of supply or demand, resulting in a significant price movement. In an imbalanced market, the price tends to move rapidly in the direction of the imbalance, as buyers or sellers rush to enter the market. Imbalances can be caused by a variety of factors, such as news events, economic data releases, or changes in market sentiment.

Traders can use AMT to identify imbalances in the market by analyzing the volume of buying and selling at different price levels. For example, if the price of an instrument is moving up rapidly and there is a high volume of buying at higher price levels, this suggests that there is an imbalance in favor of buyers. Similarly, if the price is moving down rapidly and there is a high volume of selling at lower price levels, this suggests an imbalance in favor of sellers.

By understanding whether the market is in balance or imbalance, traders can adjust their trading strategies accordingly. In a balanced market, they may look for range-bound trading opportunities, while in an imbalanced market, they may look for breakout or trend-following trades.

Initiating and Responsive Activity are two key concepts that help traders to better understand market dynamics and identify potential trading opportunities.

Initiating Activity refers to the actions of traders who are looking to enter the market by initiating a new position. These traders are typically looking to take advantage of an opportunity in the market, either by buying into an uptrend or selling into a downtrend. Initiating Activity is characterized by high volume, as these traders typically have large positions to fill.

Responsive Activity, on the other hand, refers to the actions of traders who are responding to the actions of the Initiating traders. These traders are typically looking to take advantage of the market moves initiated by the first group of traders, either by entering the market in the same direction or by taking a counter-trend position. Responsive Activity is characterized by lower volume than Initiating Activity, as these traders typically have smaller positions to fill.

In AMT, traders use these concepts to identify the dominant market participants and the direction of the market. When there is high Initiating Activity, it suggests that there is a strong trend in the market, and traders may look for opportunities to follow the trend or enter the market in the same direction as the Initiating traders. On the other hand, when there is high Responsive Activity, it suggests that the market is in a range-bound state, and traders may look for opportunities to fade the moves initiated by the other group of traders.

Traders can use different tools to analyze the market and identify the dominant market participants. For example, they may use market profile charts to visualize the volume at different price levels and identify the areas of high and low activity. They may also use technical indicators, such as momentum or volume indicators, to confirm the strength of the trend and the direction of the market.

By understanding the dynamics of Initiating and Responsive Activity in the market, traders can develop a more informed trading strategy and make better trading decisions. They can identify potential entry and exit points based on the actions of the other traders, and adjust their positions accordingly to maximize their profitability.

Acceptance and Failed Auction:

Acceptance refers to the area on the price chart where a large number of trades occurred, indicating that buyers and sellers have agreed on the fair value of the instrument. In AMT, this area is referred to as the point of control (POC) and is usually found at the center of the value area, which represents the range where 70% of the volume is traded during a particular period.

When the market reaches the point of control, traders interpret this as a sign that the market is in balance, meaning that buyers and sellers are equally interested in the instrument, and there is no significant buying or selling pressure. As a result, the price tends to trade within a range, with the point of control acting as the center of this range.

Failed Auction, on the other hand, refers to a situation where the market attempts to move beyond a certain price level, but fails to do so, resulting in a rapid reversal in the opposite direction. Traders interpret a failed auction as a sign of a potential change in the market's direction, as it suggests that there is a lack of buying or selling pressure at the current price level.

When the market attempts to move beyond a certain price level but fails to do so, it creates a price rejection pattern, which is characterized by a long wick or shadow on the price chart. Traders may use this pattern to identify potential trading opportunities, either by taking a counter-trend position or by following the new trend that may emerge after the failed auction.

Traders can use different tools to identify acceptance and failed auctions in the market, such as market profile charts, volume profiles, or price action patterns. By understanding these concepts, traders can better analyze the market dynamics and make more informed trading decisions. They can identify potential support and resistance levels, determine the direction of the trend, and adjust their positions accordingly to maximize their profitability.

There are several rules of AMT that traders use to interpret the market and identify potential trading opportunities. These rules are based on the concepts of balance and imbalance, as well as the principles of supply and demand.

Rule 1: Markets alternate between periods of balance and imbalance.

In AMT, markets are said to alternate between periods of balance, where buyers and sellers are in equilibrium, and periods of imbalance, where one group dominates the market. Traders look for these periods of imbalance to identify potential trading opportunities.

Rule 2: The market reveals its hand.

The market is constantly revealing its hand through price and volume. Traders use this information to understand market dynamics and identify potential trading opportunities.

Rule 3: The market seeks to test the edges of the trading range.

Traders look for the market to test the edges of the trading range to identify potential support and resistance levels. These levels can provide opportunities for traders to enter or exit the market.

Rule 4: Volume confirms price.

Traders look for confirmation between price and volume. For example, if the price is moving up, traders look for volume to confirm the move. If there is low volume, it may suggest that the move is not sustainable.

The graphical shape of AMT is represented by the market profile chart. The market profile chart is a vertical histogram that shows the volume of trades that occurred at different price levels. The chart is divided into horizontal sections, with each section representing a certain range of prices.

The point of control (POC) is the price level where the most volume occurred during the trading period. The value area is the range of prices that represents 70% of the volume traded during the trading period. The high and low-value areas represent the upper and lower boundaries of the balance area.

Traders use the market profile chart to identify areas of balance and imbalance. They look for areas of high volume to identify potential support and resistance levels. They also look for areas of low volume to identify potential breakouts or breakdowns in the market.

Overall, the Auction Market Theory rules and graphical shape provide traders with a framework for understanding market dynamics and identifying potential trading opportunities. By understanding these principles, traders can make more informed trading decisions and improve their profitability.

In conclusion, I've covered a lot of ground in our discussion about Order Flow and Auction Market Theory. From understanding how the markets move to identify key components of Auction Market Theory, I've explored important concepts and rules that can help traders make better decisions.

Remember that Order Flow and Auction Market Theory are just some of the many tools available to traders. While these theories can be incredibly useful in providing insights into market dynamics, it's important to approach trading with a holistic mindset and consider other factors such as fundamental analysis and technical analysis.

I hope this crash course has been helpful in giving you a better understanding of these topics, and I encourage you to stay tuned for my next post in a few days. I'll be delving into more advanced trading strategies and exploring some of the latest developments in the world of finance.

Thank you so much for this informative article! I’ve been using order flow analysis for a while now, and I’ve really felt its impact on improving the accuracy of my trades. I think combining this method with technical analysis can yield even better results. Looking forward to your next posts! 👍

Peter Steidlmayer did not invent Auction Market Theory. Auction Market Theory is a philosophy that Peter adopted and it serves as the basis of his tool that he created called market profile which is just a charting format. Market profile is just a data tool. Auction Market Theory is the philosophy and it predates Market Profile by decades.